Fishmeal will no longer be a commodity long term, as falling supply and rising demand is forcing it to become a "high-price" strategic marine protein, according to a report from Dutch lender Rabobank.

As global demand for fishmeal is rising -- driven by the growth of the aquaculture industry -- while supply is declining, prices are "naturally expected to rise", Rabobank said.

This will impact the traditional role of fishmeal as a commodity to become a "strategic ingredient" when other protein sources cannot be used, a trend that, already, is starting to be visible in fish oil.

In 2014/15, fishmeal was in short supply due to the cancelation of last year's second Peruvian fishing season, linked to an El Nino weather phenomenon.

Although the fishery has since normalized and a price correction is already occurring, this is part of the short-term dynamics.

"In the long term, we expect the upward sloping oscillating price line to continue, with the peaks marked by short-term supply changes, but displaying long-term price support," Rabobank said.

"Clearly, with a volatile, but long-term declining supply and rising prices, the use of fishmeal and fish oil will be rationed to a part of the market which has a strategic use for it," it said.

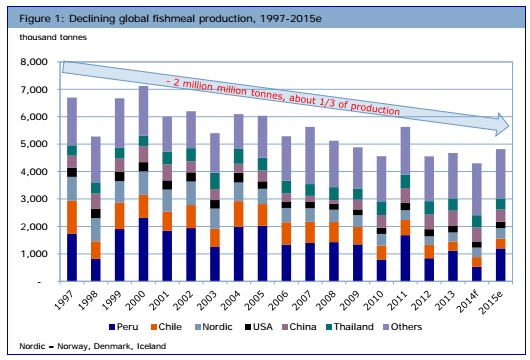

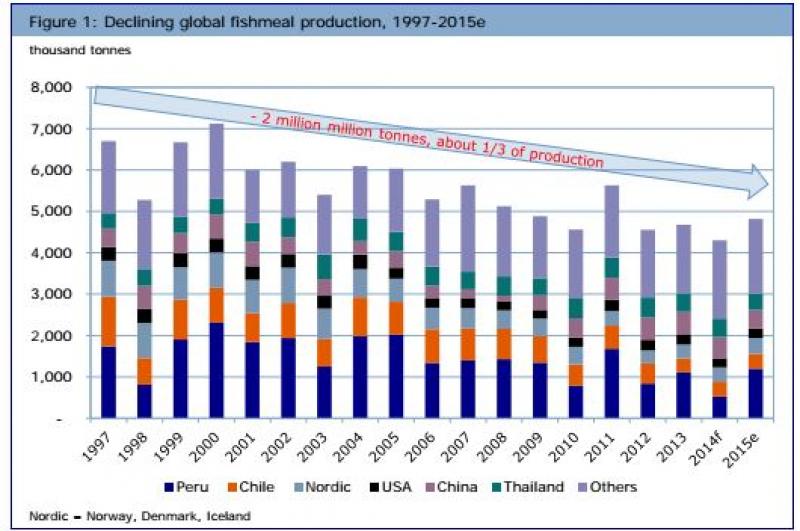

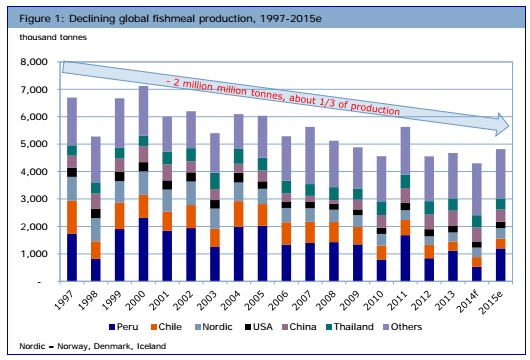

Declining supply to boost prices

Although demand is strong, supply of fishmeal and fish oil is under pressure (see image below).

The decline in supply has been driven by both lower wild catch of small pelagics and, more importantly, increasing direct human consumption of these species, which is likely to put ongoing pressure on animal and aqua feed producers -- the key competitors for fishmeal.

Wild catch of key small pelagic species used in the production of fishmeal has declined: such as the anchovy catch in Peru; jack mackerel and sardines in Chile; and blue whiting, capelin and sand eels in Europe.

In some cases, such as the decline in jack mackerel catches, the historical harvest levels were not sustainable, Rabobank said.

"It will take some time before a recovery occurs, and the fishery will probably never reach the former level," it said.

Although Europe has seen a recovery of the blue whiting fishery boosting fishmeal production, the total small pelagic harvests are unlikely to return to the levels seen in the early 2000s or the 1990s, Rabobank said.

Source: Rabobank, Kontali, IFFO, 2015

In addition to the volatility and downward trend in the wild harvest of small pelagics, there has also been an increase in human consumption -- reducing the raw material available for fishmeal.

In Peru and Chile as well as in Europe, all key producers have made investments in plants and infrastructure to supply human consumption markets.

Peruvian fishmeal producers such as Pesquera Pesquera Exalmar and Pesquera Hayduk have revealed investments to push for food fish, while salmon producers Bakkafrost and Framherji have made investments in the new pelagic plant in the Faroes, Pelagos.

The key products are either frozen pelagics, mostly for African markets, or canned products consumed in many developing markets across Latin America, Africa and Asia.

These species represent not only the lowest cost seafood but also the lowest cost animal protein in the world, Rabobank said.

For instance, in Nigeria -- Africa’s leading importer of seafood -- whole small pelagics are sold frozen to end consumers for between $0.20 per kilo to $0.60/kg.

"At this price, there is no alternative animal protein," Rabobank said.

"With a rising population, failing local fisheries in rivers and lakes and an increasingly higher cost of animal protein, demand for small pelagics is only expected to grow," it said.

Also, there have been recent investments to produce high-value food ingredients for human consumption, using small pelagics as a raw material for the production of omega-3 capsules, for instance.

"This trend will further shift the use of small pelagics towards human consumption markets, reducing the production of fishmeal, Rabobank said.

Fish oil changing dynamics

The fish oil market has, already, seen changing dynamics due to its source of omega-3 unsaturated fatty acids -- a unique feature compared to other oils -- for feed or human consumption.

The aquaculture industry is the main buyer for fish oil globally, consuming some 74% of available supply, primarily for use in salmon feed.

"The salmon industry currently uses approximately 7-9% fish oil in the feed formula. This amount could probably be reduced to 5-6%, but any lower than this could negatively impact the performance of the feed," Rabobank said.

02923.841.415

02923.841.415